capital gains tax changes canada

The inclusion rate is the percentage of your gains that are subject to tax. For a Canadian who falls in a 33 marginal.

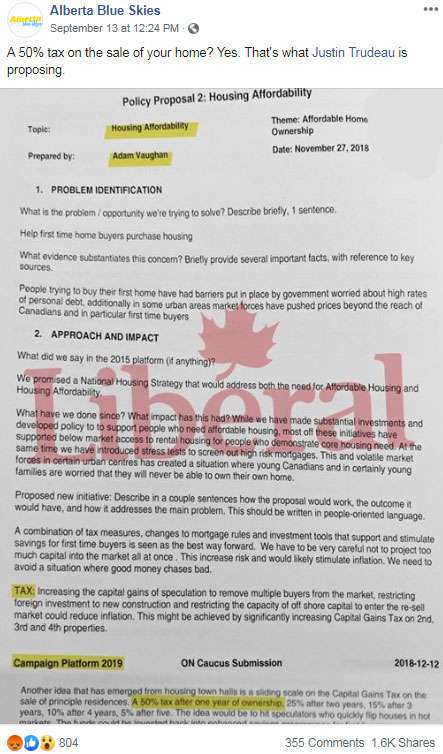

Fact Check Canada S Liberals Plan Capital Gains Tax On Home Sales

The government would like to see the tax rate on both capital gains and dividend income be the same.

. Capital gains are part of the taxpayers comprehensive income and in a fair and efficient tax system they should be subject to taxation just like other income. Expected under Liberal government. The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer rate.

The Royal Commission on Taxation led by Kenneth Carter had earlier recommended that since capital gains gifts and. This means that only half of your capital. In Canada 50 of the value of any capital gains are taxable.

You can reduce or avoid capital gains tax by selling your inherited home among other options. The maximum pensionable earnings is. The capital gains tax in Canada was implemented in 1972.

NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income. Paragraph 9 of Article XIII of the 1980 Convention provides a transitional rule reflecting the fact that under Article VIII of the 1942 Canada-United States Income Tax Convention hereinafter.

The inclusion rate has varied over time see graph below. When the tax was first. The federal governments 1971 decision to include capital gains in income was part of a sweeping change to the Canadian income tax system.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. The below outlines the current tax treatment of capital gains in Canada and the US the appetite for change in each country and a few questions to ask your financial planner. For now the inclusion rate is 50.

Capital Gains Tax Rate. Whats new for capital gains - Canadaca Whats new for capital gains Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation. Over the years the taxation of.

There have been ongoing rumors about the Canadian government potentially increasing the capital gains inclusion rate from its current level of 50 to a higher level or. Currently depending on your tax bracket a capital gain is taxed at a rate. If you are liable for capital gains tax there are some options to reduce your tax bill.

On the flip side an. The inclusion rate refers to how much of your capital gains will be taxed by the CRA. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the.

Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. And the tax rate depends on your income. As of 2022 it stands at 50.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Should you sell the investments at a higher price than you paid realized capital gain.

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

Taxes On Capital Income Are More Than Just The Corporate Income Tax

2020 2021 Capital Gains And Dividend Tax Rates Wsj

How Are Capital Gains Taxed Tax Policy Center

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

How Are Capital Gains Taxed Tax Policy Center

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Short Term And Long Term Capital Gains Tax Rates By Income

Capital Gains Tax Break Becomes Part Of A Double Whammy When Home Prices Fall Don Pittis Cbc News

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

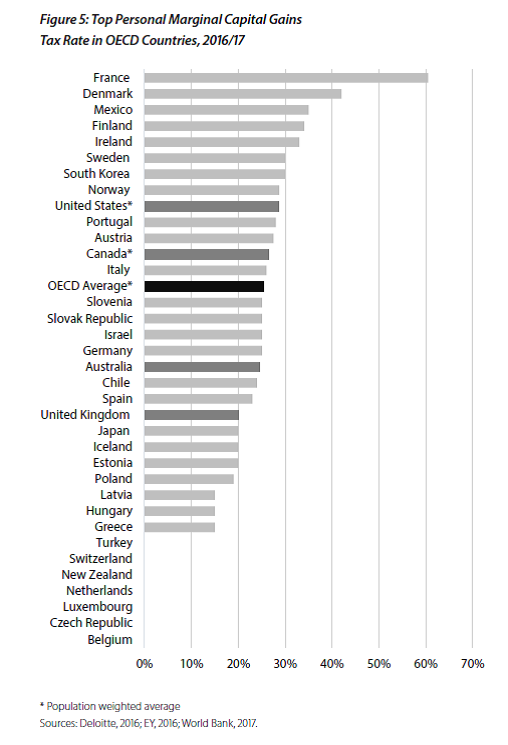

Demographics And Entrepreneurship Blog Series Spurring Entrepreneurship Through Capital Gains Tax Reform Fraser Institute

Tax Foundation President Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top Integrated Tax

The Tax Impact Of The Long Term Capital Gains Bump Zone

Canada Capital Gains Tax Calculator 2022

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

The Liberal Party S Housing Policy Does Not Include A Capital Gains Tax On Primary Home Sales Fact Check